what is a good apr for a car payment

Using the same figures from above a 4 rate on. A car loan interest rate is how much you pay every year as a percentage of the principal the amount borrowed while APR also includes other additional charges and costs of borrowing.

So while your car payment is 10 of your take-home pay you should plan.

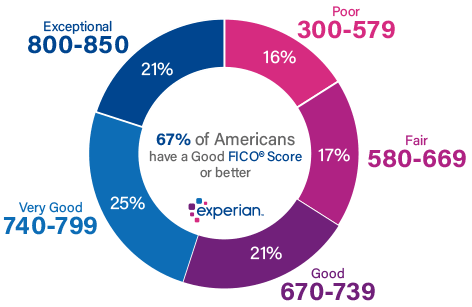

. It could change your interest rate by 12 or more. For those with a high credit score a rate lower than 234 would be considered above average but if your credit score falls below 500 getting an APR lower than 14 would be. The type of car youre trying to secure a loan for can also impact your APR.

The difference between a 382 monthly car payment and a 429 monthly car payment is only 47 per month. Many financial experts recommend keeping total car costs below 15 to 20 of your take-home pay. An interest rate is the percentage banks charge you for borrowing money.

Although theres always going to be some wiggle room the average used car loan interest rates are as follows. If you dont you can easily estimate your. And if that werent bad.

For used vehicles the average interest rate can range from 361 APR with Super Prime to 1987 for Deep Subprime. According to the Federal Reserves data the average interest rate on a. Although there are credit cards with zero introductory APR their interest is higher after the introductory period.

If you already know your estimated monthly loan payment you can skip this step. Excellent Credit 750 or Higher 51. The average new car payment in America has crept above the 500 per month mark for the fist time settling in at 503 according to a recent study by Experian.

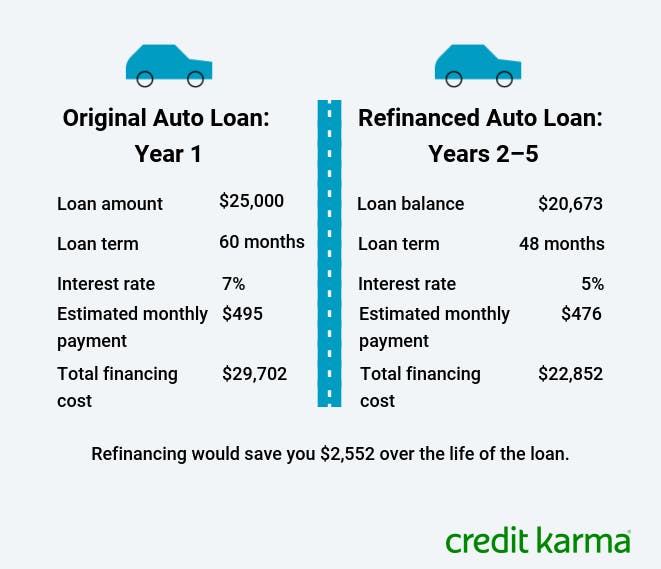

A good rate will also result in you spending less money on interest potentially saving you thousands over the life of the loan. The possibility to earn rewards on a large purchase like the. The best interest rates for a car loan sit just above 2.

The Experian study mentioned above found that the most creditworthy borrowers paid an average interest rate of 429 on a used car loan while the least creditworthy paid an. But to get these rates youll need to have phenomenal credit and youll likely need to work with a credit union. Example auto loan payment.

What is a good APR for a car loan. If you can get a rate under 6 for a used car this is likely. If you dont have great credit you can expect to have a higher interest rate and pay more in total interest over the total life of your auto loan than.

One such concept is the annual percentage rate or APR. If you have bad credit or no. Calculate your monthly estimated payment.

The APR expresses the. One of the sole benefits of using a credit card for the down payment on a car is the ability to earn credit card rewards. If you have excellent credit and are able to secure a low interest rate of 3 you will pay 354 a month and 999 in interest over the life of the loan.

Car loan interest rates vary widely and your credit score is the biggest factor. Interest rates tend to be higher for. When it comes time to finance a new or pre-owned car several terms are important to understand.

When you make monthly payments on a car loan your payment will go toward both your principal balance and.

Report Auto Refinance Applications On The Rise As Interest Rates Drop Rategenius

What Credit Score Is Needed To Buy A Car Capital One Auto Navigator

Best Sports Car Deals In September 2022 U S News

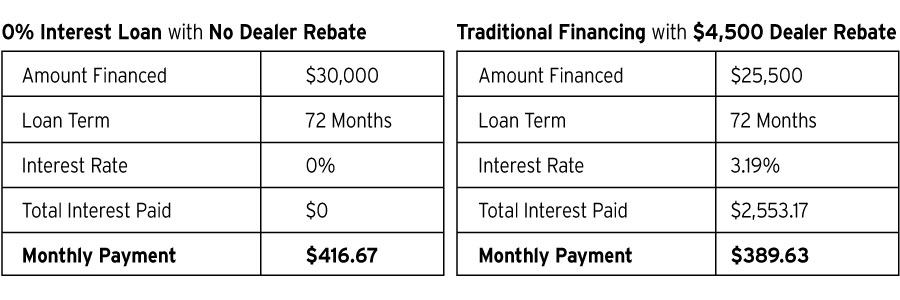

A Complete Guide To 0 Apr Car Loans Diamond Cu

How To Lower Apr On A Car Loan Roadloans

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

How Refinancing A Car Loan Works With Bad Credit

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

Check Out Average Auto Loan Rates According To Credit Score Roadloans

What Should Your Average Car Payment Be Sofi

How Do Low Rates Help You Save

The Best Place To Get A Car Loan Credit Karma

Average Auto Loan Interest Rates Facts Figures Valuepenguin

0 Apr Car Deals Are They Worth It Forbes Advisor

How To Negotiate A Car Loan Experian

Auto Loan Rates As Low As 1 99 No Payment For 90 Days Bowater Credit Union